By William Craighead

The U.S. economy entered 2025 in strong shape. Although grumbling about prices had become an entrenched habit, the data showed that inflation was well down from its mid-2022 peak. GDP and productivity growth rates were both healthy. A weakening trend in the labor market appeared to have levelled off in the second half of 2024 with unemployment still at a low level.

Three months into the year, the economic outlook has darkened considerably because of uncertainty emanating from Washington. With the changes in government spending and tariffs, what is happening is negative for economic activity, but the more serious damage may come from how it is being done.

First, the reductions in services directed by Elon Musk – these have been attention-grabbing and may degrade the quality of federal efforts in areas ranging from aviation safety to wildland firefighting and veterans’ services, while also jeopardizing American leadership in medicine and science. However, the dollar amounts appear to be fairly small relative to the overall size of the U.S. economy and to total federal outlays (which are mainly driven by Social Security, Medicare and interest payments). Note this means that the impact on the federal budget deficit is also minor.

If these cuts were coming in a clear and predictable manner through the normal appropriations process, the short-run impact on the overall U.S. economy would likely be modest. However, the chaotic and nontransparent manner of their execution, exacerbated by questions about legality and judicial interventions (under the Constitution, Congress has “the power of the purse”) means that all organizations who work with the federal government – e.g., contractors and grant recipients – are facing elevated uncertainty, as the way the government does business is fundamentally unsettled. This may lead them to hold off on investment. This is particularly relevant in the Colorado Springs area with its large federal government footprint (at 3.8%, the federal government share of civilian employment here is twice the national percentage).

Second, tariffs – mainstream economists see these as harmful distortions that result in less efficient use of resources and therefore lower standards of living. Imposing taxes on imports from our three largest trading partners, as well as on key industrial inputs like aluminum and steel, raises the cost of living and puts American firms that use imported parts and materials at a disadvantage.

However, as a large economy with abundant natural resources, the U.S. can still be successful (if slightly poorer) with less international trade. But the constantly shifting and escalating tariff threats, punctuated by short-term “pauses,” create an incentive to postpone investment. Firms facing higher project costs have an incentive to wait and see if tariffs will be lifted. Meanwhile, businesses that might wish to expand production of domestic substitutes for imported goods will be hesitant about making investments based on tariffs which might not stay in place.

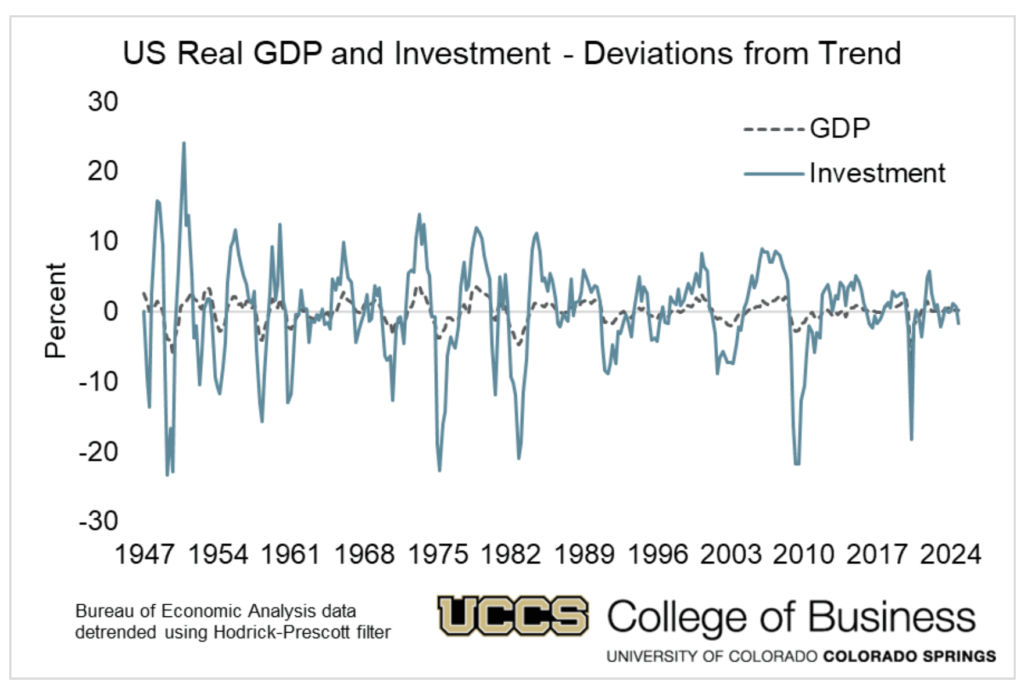

While consumption is the largest component of GDP, investment is the most volatile. The uncertainty created around trade policy as well as the federal government’s reliability as a business partner are undermining the environment for investment. A pullback in investment in industries most directly impacted will result in lower demand elsewhere in the economy, reducing employment, income and spending. That’s one reason why the word “recession,” which was hardly uttered at the beginning of 2025, is back in the conversation.